CPA vs ACCA

CPA (Certified Public Accountant) and ACCA (Association of Chartered Certified Accountants) are both professional accounting qualifications. CPA is based in the United States, while ACCA is based in the United Kingdom. Both qualifications are essential for those considering a career in accountancy and are highly regarded within the industry.

What is CPA?

CPA refers to Certified Public Accountant in the United States, with several branches across the states. To practice as a public accountant in the US, one needs a CPA license, which is provided by the individual’s state of residence. The requirements for obtaining a CPA license vary from state to state, but generally involve a three-step approach: Education, Examination, and Experience.

The CPA examination is conducted by the American Institute of Certified Public Accountants (AICPA) and consists of four sections: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation. To qualify, a candidate must score over 75% in all four sections.

In addition to passing the examination, those pursuing a CPA license must also possess relevant work experience, typically 1 to 2 years under a CPA. However, the term “CPA” represents different bodies in different countries, such as Chartered Professional Accountants in Canada and Certified Practising Accountants in Australia.

What is ACCA?

ACCA, or Association of Chartered Certified Accountants, was established in 1904 in the United Kingdom. It has since grown to have members in countries worldwide. To become a Member of ACCA, one must pass the exams leading to ACCA professional qualification, complete the professional ethics module, and have at least three years of relevant work experience.

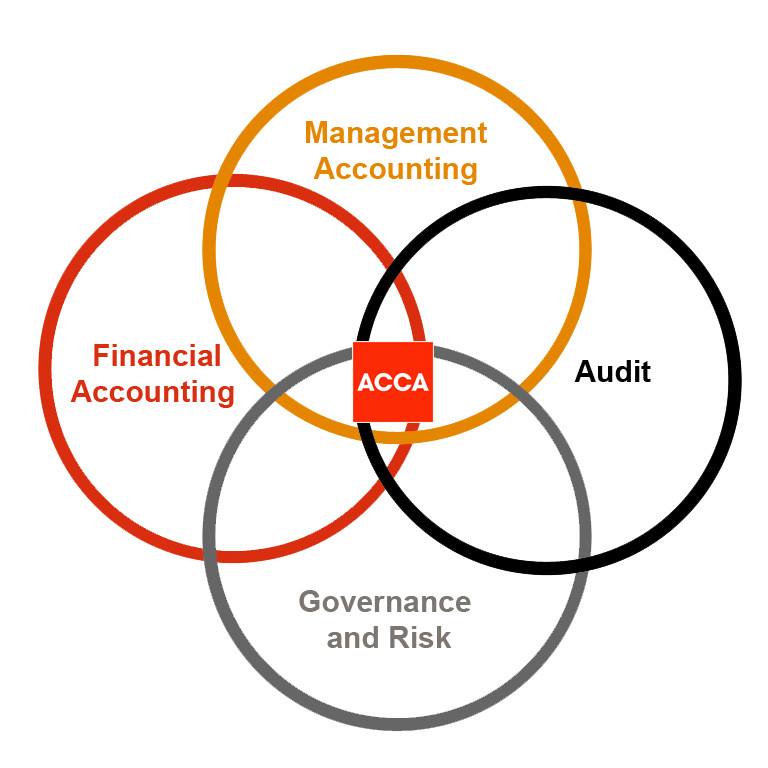

ACCA’s study program focuses on various aspects of accounting, such as Corporate Reporting, Leadership and Management, Strategy and Innovation, Financial Management, Sustainable Management Accounting, Taxation, Audit and Assurance, Governance, Risk and Control, Stakeholder Relationship Management, and Professionalism and Ethics.

The ACCA program is divided into Foundation Level and Professional Level, with entry requirements for the latter being a pass in GCSE 3 subjects and A Levels 2 subjects, including Maths and English. The Professional Level is further divided into three levels: Level 1 Fundamentals – Knowledge, Level 2 Fundamentals – Skills, and Level 3 Professional – Essentials and Options.

Key Takeaways

- Both CPA and ACCA are professional accounting qualifications, with CPA based in the US and ACCA based in the UK.

- CPA licenses are specific to a state in the US, while ACCA is a globally recognized qualification.

- ACCA offers educational programs leading to professional accounting qualifications, while CPA is primarily a professional body.